The financial services sector is undergoing a tremendous transition. Customer expectations are rising, regulations are becoming more complex, and new technologies are emerging at a rapid pace. The integration and management of data across diverse systems play a pivotal role in achieving these goals. A study of APAC financial service providers found that compliance expenses rose 20%-35% annually between 2005 and 2016. According to another survey, banks spent 7% of their non-interest expenses on compliance. The rate is 9.8% for small community banks and 5% for large commercial banks. This underscores the critical need for robust solutions that can streamline operations and enhance efficiency.

To overcome this scenario, financial institutions need a robust data management strategy and the ability to seamlessly integrate disparate systems. This is where Boomi, a leading Integration Platform as a Service (iPaaS) solution, comes into play.

The Role of Integration in Financial Services

Integration of disparate systems and applications is essential for financial institutions to operate smoothly. Traditionally, these institutions have relied on complex, often manual processes to connect various IT systems. This method raises the possibility of errors and compliance problems while simultaneously reducing operational efficiency. In contrast, modern integration platforms like Boomi offer a unified solution to seamlessly connect applications, data, and processes across cloud and on-premises environments.

Streamlining Data Integration with Boomi

Boomi’s comprehensive iPaaS simplifies data administration for financial institutions. By leveraging Boomi, these institutions can integrate customer data from different sources such as CRM systems, banking platforms, and third-party applications in real time. This capability ensures that accurate and up-to-date information is readily accessible across the organization, enabling faster decision-making and improving operational agility.

Streamlining Data Integration: Breaking Down Data Silos

Financial organizations often have a sophisticated IT infrastructure that includes several apps and databases. This fragmented landscape can lead to data silos, where valuable information gets trapped within specific systems. Boomi helps break down these silos by providing a unified platform for data integration. It allows institutions to connect various applications, including core banking systems, customer relationship management (CRM) tools, and anti-money laundering (AML) software. This streamlined and efficient data flow enables financial organisations to:

- Gain a 360-degree view of the customer: Through the process of combining client data from many sources, institutions are able to construct a comprehensive profile for each individual customer. This includes information on their account activity, investment holdings, and past interactions. With this comprehensive approach, financial institutions can personalise products and services, resulting in enhanced client satisfaction and loyalty.

- Improve operational efficiency: Boomi automates manual data transfer processes, eliminating the need for repetitive tasks. This frees up valuable resources and reduces the risk of errors associated with manual data entry. Additionally, by streamlining workflows, Boomi helps institutions process transactions faster and improve overall operational efficiency.

- Make data-driven decisions: With centralized and integrated data, institutions can leverage analytics tools to gain valuable insights. This enables them to discern patterns, predict customer requirements, and make well-informed strategic decisions.

Ensuring Regulatory Compliance: Mitigating Risks and Building Trust

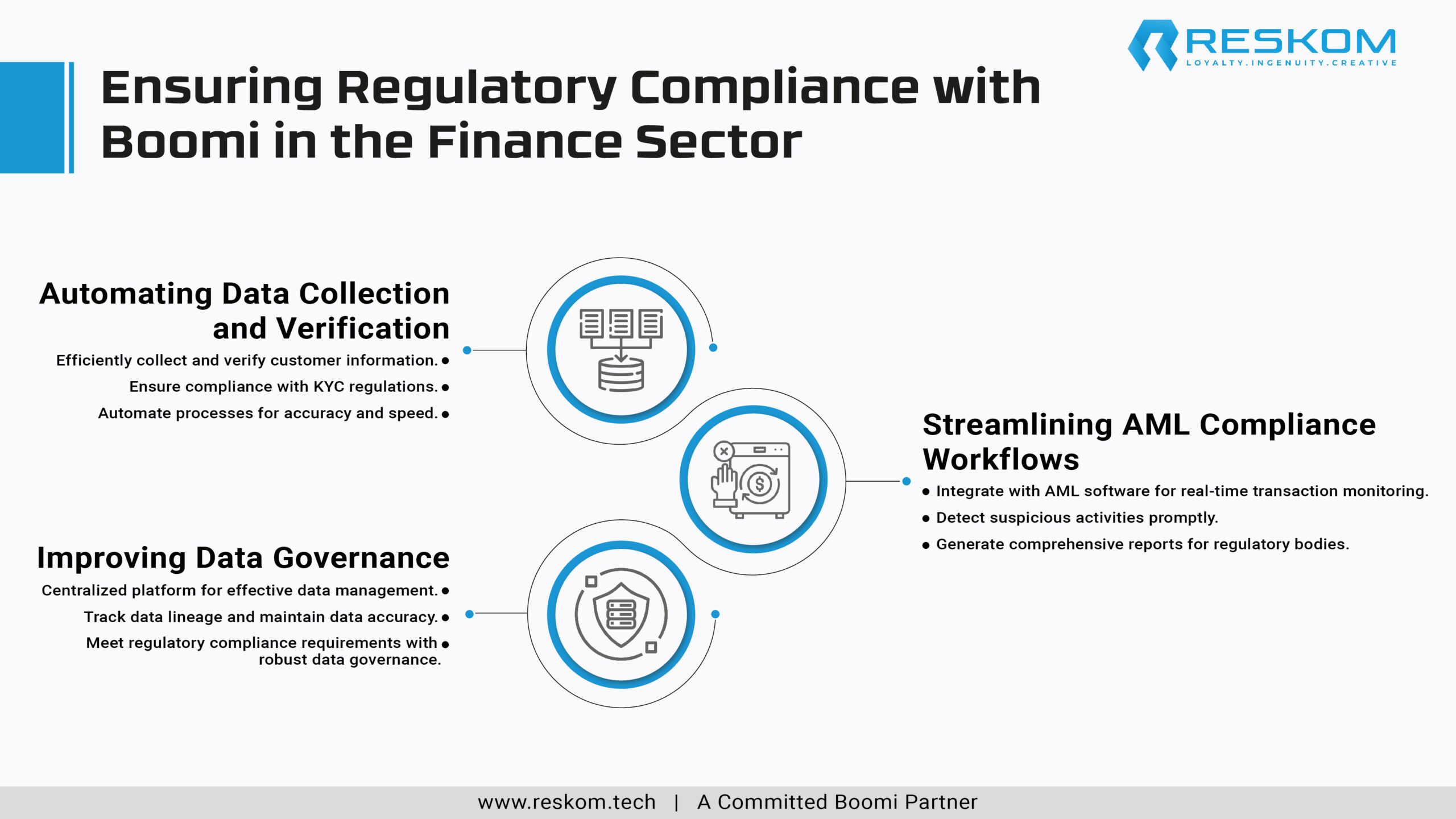

Compliance with regulations such as GDPR, PCI-DSS, and KYC/AML is non-negotiable for financial institutions. Noncompliance can result in significant sanctions and harm to the reputation. Boomi helps mitigate these risks by providing built-in compliance features and robust security protocols. It ensures that sensitive customer information is handled securely and in accordance with regulatory requirements, thereby maintaining trust and integrity. Boomi plays a critical role in ensuring regulatory compliance by:

- Automating data collection and verification: Boomi automates the process of collecting and verifying customer information, such as name, address, and date of birth. This helps institutions comply with KYC regulations efficiently.

- Streamlining AML compliance workflows: Boomi integrates with AML software, allowing institutions to monitor transactions for suspicious activity in real-time. Additionally, Boomi helps generate reports required by regulatory bodies.

- Improving data governance: Boomi provides a centralized platform for data management, making it easier for institutions to track data lineage and ensure data accuracy. This robust data governance is essential for meeting regulatory compliance requirements.

Case Study: Fulton Bank Leverages Boomi for Success

Fulton Bank, a prominent financial institution in the United States, implemented Boomi to enhance its data integration capabilities. By consolidating disparate systems onto a unified platform, Fulton Bank achieved significant operational efficiencies and improved data accuracy. This streamlined approach not only reduced IT complexity but also enabled the bank to launch new services faster while ensuring compliance with industry regulations. By using Boomi, Fulton Bank achieved the following key results:

- A 3X anticipated acceleration in integration development and deployment

- Simplified rollout of fresh fintech partner services

- Reduced technological debt while optimizing technology expenditure

- Reduced reliance on costly outside services

Key Benefits of Boomi for Financial Institutions

- Efficiency Gains: Boomi automates data integration processes, reducing manual effort and operational costs.

- Scalability: The platform scales seamlessly as business needs grow, supporting increased data volumes and transaction complexity.

- Real-time Insights: By enabling real-time data synchronization, Boomi empowers financial institutions to make informed decisions quickly.

- Improved Customer Experience: Integrated systems ensure a consistent customer experience across all touchpoints, enhancing satisfaction and loyalty.

Enhancing Customer Experiences through Integration

In today’s competitive landscape, delivering exceptional customer experiences sets financial institutions apart. Boomi enables these institutions to create a unified view of customer data, facilitating personalized services and targeted marketing campaigns. By integrating customer information across channels, banks can provide seamless omnichannel experiences, from online banking to mobile applications, thereby increasing customer satisfaction and loyalty.

Real-World Applications of Boomi in Financial Services

Financial institutions leverage Boomi not only for data integration but also for automating workflows and orchestrating business processes. This automation reduces manual intervention, minimizes errors, and accelerates time-to-market for new products and services. Additionally, Boomi’s scalability ensures that financial institutions can adapt to changing market dynamics and scale operations as needed without compromising performance.

Boomi’s cloud-native architecture facilitates rapid deployment and scalability without the need for extensive hardware investments. Its visual interface allows non-technical users to design and deploy integrations efficiently, reducing reliance on IT resources. This democratization of integration empowers financial institutions to innovate and respond to market demands swiftly.

Conclusion: Optimizing Financial Services with Boomi

In conclusion, Boomi is a powerful tool that can help financial institutions streamline data integration, ensure regulatory compliance, and enhance customer experiences. By breaking down data silos, automating manual processes, and providing a centralized platform for data management, Boomi empowers financial institutions to operate more efficiently and effectively in a dynamic and competitive market.

RESKOM is a leading cloud solution provider with extensive expertise in Boomi implementation. We can help your financial institution leverage the power of Boomi to achieve your business goals. Contact us to learn more about our Boomi services.